How Data and AI Are Transforming Traditional Economic Concepts

AI and data don’t replace economic theory—they rewire how its principles behave in the digital economy.

When I first introduced data-driven economic concepts such as the Data Economic Multiplier Effect, the Marginal Propensity to Reuse (MPR), the Marginal Propensity to Learn (MPL), and Nanoeconomics, my goal was to create a framework for measuring and monetizing how organizations use advanced analytic tools like AI to extract and amplify value from data.

These principles represent a new branch of economic thinking—Data Economics—where the assets that drive growth are not physical or financial, but digital, reusable, and self-reinforcing.

Table 1 below provides a quick refresher on these modern data-driven economic concepts and why they matter in shaping the next generation of intelligent organizations.

Table 1: Quick Refresher: Modern Data-driven Economic Concepts

Why Traditional Economics Needs a Reframing

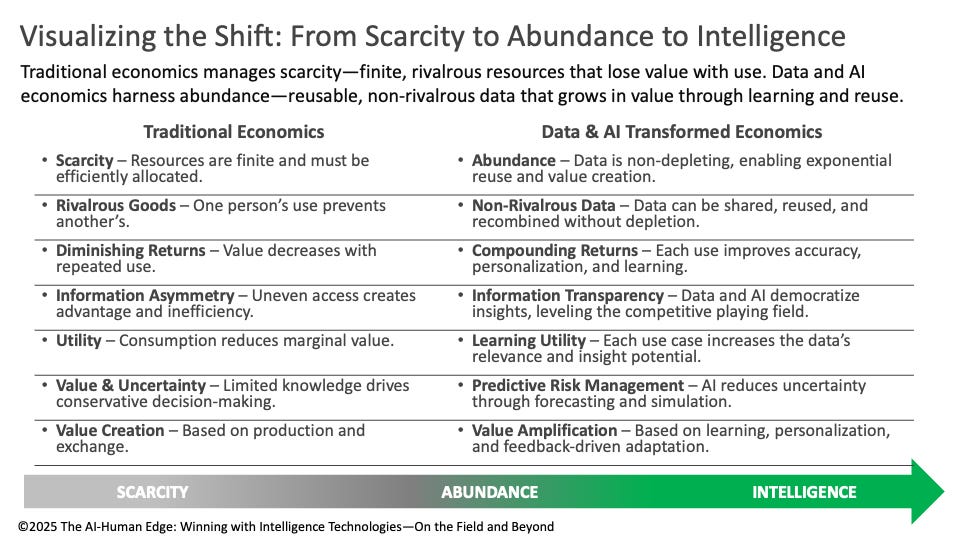

Traditional economics was built for a world of scarcity — a time when resources were finite, rivalrous, and depreciated with use. Its models are optimized for efficiency, equilibrium, and allocation — deciding how best to distribute what is limited.

But the digital economy runs on data, and data behaves differently. Data is abundant, non-rivalrous, and reusable. When shared or combined with other datasets, its value doesn’t diminish — it compounds.

This shift from scarcity to abundance breaks many of the assumptions that shaped classical economics. In a data-rich world:

Supply and demand no longer operate on depletion but on connectivity — the more data you have and share, the more valuable it becomes.

Utility no longer declines with use; it compounds through context, personalization, and feedback.

Risk and uncertainty are not just managed but modeled — reduced through predictive analytics, scenario testing, and reinforcement learning.

Value creation isn’t confined to production; it now occurs through reuse, learning, and the exchange of insights.

As organizations adopt AI and data-first strategies, they’re not abandoning economics — they’re retraining it. The same foundational principles — utility, value, risk, supply, and demand — still apply, but they now operate within self-learning systems fueled by feedback loops, algorithms, and continuous reuse.

In this new environment, the firm’s economic advantage no longer comes from control over scarce assets but from the ability to learn faster, reuse smarter, and adapt sooner than competitors.

Setting the Stage: Rewriting the Economic Playbook

The transformation of traditional economic concepts isn’t theoretical—it’s structural. Data and AI have introduced new behaviors into the economy that fundamentally alter how value is created, measured, and exchanged. Traditional economics was optimized for scarcity, equilibrium, and efficiency; data economics thrives on abundance, feedback, and continuous learning. In this new environment, supply and demand are no longer static—they synchronize dynamically. Utility doesn’t diminish—it compounds through context and reuse. Risk is no longer hidden—it’s modeled and anticipated.

Table 2 contrasts how data and AI capabilities reshape each classical economic principle—showing how yesterday’s static models evolve into living systems of intelligence, adaptability, and exponential value creation.

Table 2: How Data and AI Transform Traditional Economic Concepts

Figure 1 captures the fundamental shift from traditional economics to data-driven economics. For centuries, economies were built to manage scarcity—optimizing finite, rivalrous resources for maximum efficiency. In the digital era, data and AI introduce abundance: information that can be reused, recombined, and shared without depletion. But the transformation doesn’t stop there. As AI systems learn and adapt, we enter the era of intelligence economics—where value continuously amplifies through feedback loops, personalization, and predictive learning. The flow from scarcity to abundance to intelligence illustrates not just a change in scale, but a change in the physics of value creation itself (Figure 1).

Figure 1: Visualizing the Shift: From Scarcity to Abundance to Intelligence

Key Insights: How the Shift Plays Out:

From Scarcity to Abundance: Data is non-depleting. Every use increases its utility.

From Diminishing to Compounding Returns: Instead of depreciating, data appreciates with use.

From Information Asymmetry to Transparency: Data democratizes access and introduces new challenges around bias and trust.

From Value Creation to Value Amplification: Each reuse compounds insight-driven value.

From Utility to Learning Utility: Every transaction generates new data that improves future outcomes.

Let’s deep-dive into specific data and AI-driven examples of traditional economic transformation.

Data and AI-driven Traditional Economics Transformation

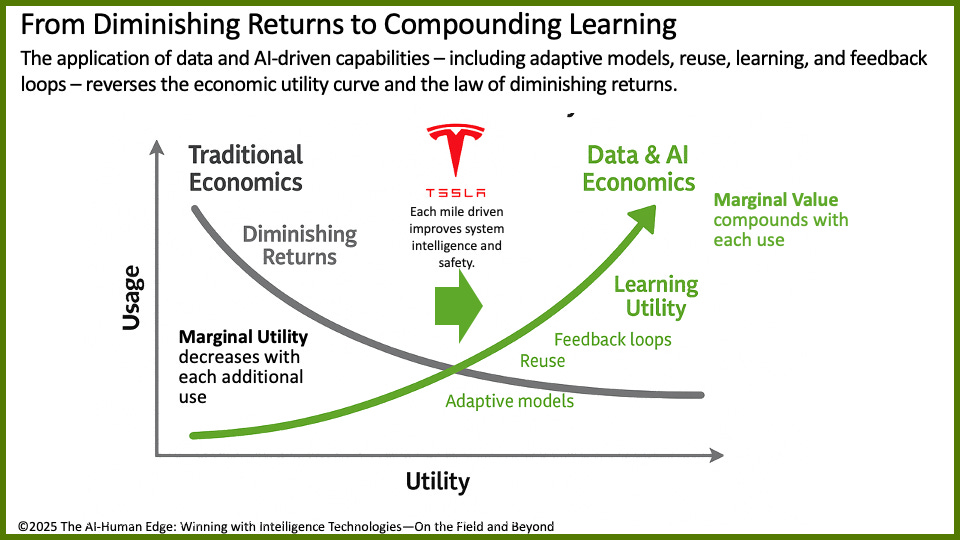

From Diminishing Returns to Compounding Learning

Traditional economics assumes the law of diminishing returns, which holds that each additional input yields progressively less value. But in the world of data and AI, that logic flips. Each new data point, model iteration, or user interaction increases system intelligence, precision, and adaptability. This shift replaces diminishing returns with learning utility—a compounding effect in which feedback loops, reuse, and adaptive models create accelerating returns over time. Tesla exemplifies this principle: every mile driven generates new insights that improve vehicle performance, safety, and driver experience. In data-driven economics, value doesn’t decay with use—it multiplies through learning (Figure 2).

Figure 2: From Diminishing Returns to Compounding Learning

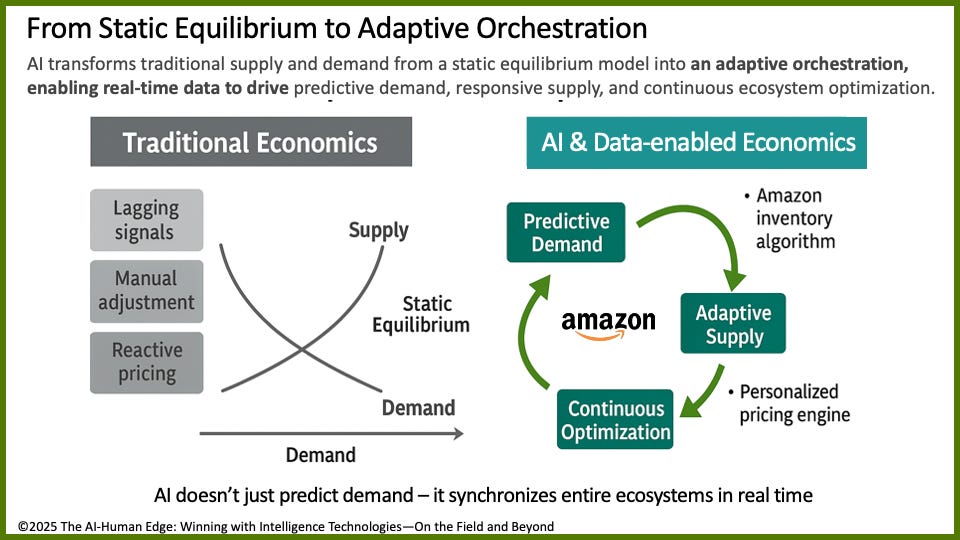

From Static Equilibrium to Adaptive Orchestration

Traditional supply-and-demand models rely on lagging indicators and manual adjustments to maintain balance—an approach suited to slower, less connected markets. In contrast, data and AI transform this equilibrium into adaptive orchestration, where predictive analytics and real-time feedback continuously synchronize production, pricing, and delivery. Amazon epitomizes this transformation: its AI-driven inventory and pricing engines anticipate demand shifts before they occur, dynamically aligning supply chains with consumer behavior. In this new model, equilibrium is no longer a point on a curve—it’s a living, learning system that perpetually optimizes itself (Figure 3).

Figure 3: From Static Equilibrium to Adaptive Orchestration

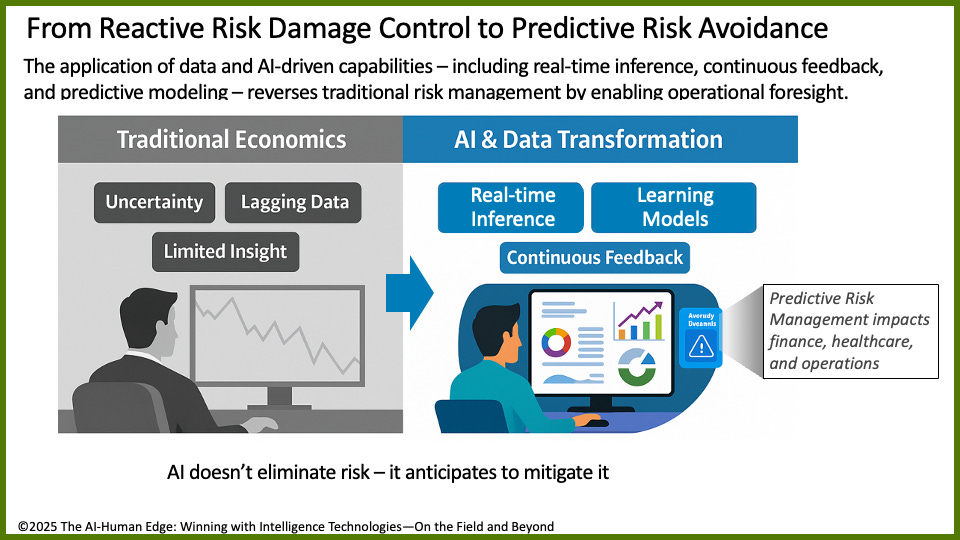

From Reactive Risk Control to Predictive Risk Management

In traditional economics, risk management is backward-looking—driven by lagging data, uncertainty, and delayed response. AI transforms this paradigm from reactive control to predictive foresight by continuously analyzing patterns, learning from feedback, and adapting in real time. Through real-time inference and self-improving models, organizations can anticipate emerging risks before they materialize, dynamically adjusting operations, supply chains, and financial exposure. Predictive risk management doesn’t eliminate uncertainty—it converts it into a source of strategic advantage by turning foresight into preparedness (Figure 4).

Figure 4: From Reactive Risk Damage Control to Predictive Risk Avoidance

The Data Flywheel of Value Creation

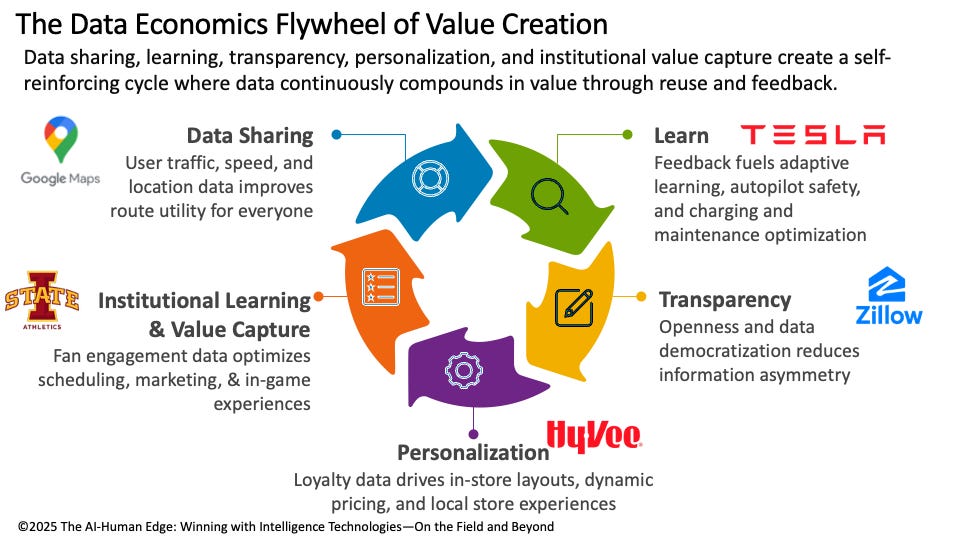

To see this transformation in action, consider five modern examples in which data and AI are reshaping value creation across industries (Figure 5).

Tesla → Risk Reduction & Compounding Value

Every mile driven enhances Tesla’s Autopilot learning, improving safety and efficiency for all vehicles.

Lesson: Each data point reduces uncertainty and compounds system-wide value.

Google Maps → Non-Rivalrous & Utility

Every user contributes data that improves route accuracy for everyone else—demonstrating data’s non-rivalrous nature.

Lesson: Each user interaction increases the system’s collective utility.

Zillow → Information Asymmetry & Opportunity Cost

By making real estate data public, Zillow reduced asymmetry but revealed new biases, illustrating that transparency demands accountability.

Lesson: Transparency creates new value but also new responsibilities.

Hy-Vee → Liquidity & Personalization

Loyalty and shopping-app data help Hy-Vee tailor promotions and layouts dynamically, turning transactions into continuous feedback loops.

Lesson: Local data liquidity drives adaptive, community-level personalization.

Iowa State Athletics → Network Effects & Value Capture

Fan engagement, ticketing, and concession data improve operations and enhance the fan experience.

Lesson: Each fan interaction enriches future experiences—compounding institutional learning and loyalty.

Figure 5: The Data Economics Flywheel of Value Creation

The Data Economics Flywheel illustrates how data, when continuously shared, reused, and learned from, becomes a self-reinforcing economic engine. Each interaction—whether a Tesla vehicle driving a mile, a Hy-Vee customer making a purchase, or an ISU fan scanning a ticket—feeds intelligence back into the system, making every future interaction smarter and more valuable. Unlike traditional economies that extract and exhaust value, data-driven systems amplify it through learning and reuse. This is the compounding effect at the heart of data economics: the more a system is used, the more efficient, personalized, and intelligent it becomes—transforming feedback into foresight and experience into exponential growth.

Closing: The Rise of the Intelligence Economy

In the 20th century, capital flowed toward scale and efficiency. In the 21st century, it flows toward learning and adaptability. AI and data have rewritten the laws of value creation, forming systems that don’t just act—they learn, predict, and improve. Each interaction strengthens the next, driving a continuous loop of compounding insight, reuse, and refinement. This is the foundation of the Intelligence Economy—a world where every decision, model, and human contribution accelerates collective learning and system-wide performance.

Traditional economics was designed for a world of limits, where value diminished with use. Data economics operates in a world of compounding, where every reuse expands potential and every feedback loop amplifies value. Organizations that master this shift—from extraction to expansion, from optimization to adaptation—will define the next era of economic progress.

The promise of the Intelligence Economy isn’t automation—it’s acceleration. It’s about creating systems that learn faster than they cost to run, where knowledge compounds, foresight deepens, and collaboration fuels competitive advantage. In this new age, intelligence itself has become the ultimate currency of growth.