“Do More with Less” – Data-Driven Economics is Rewriting the Value Curve

“Doing more with less” isn’t just a catchy phrase—it’s quickly becoming the defining economic conversation of our time. In the age of AI, digital transformation, and mounting operational pressures, this phrase captures the core challenge faced by every organization: how to create more meaningful value without a proportional increase in resource consumption. It's no longer just about trimming budgets or squeezing efficiency out of aging systems. It’s about making strategic choices—where to invest, what to automate, what to simplify, and most critically, what to stop doing. To truly 'do more with less,' organizations must move beyond generic automation and adopt an economic mindset that treats AI and data as tools and strategic levers to reshape their value curves.

Organizations must shift from broad cost-cutting efforts to smarter, precision-oriented resource allocation. This means identifying and investing in data and AI assets that act as force multipliers while reallocating resources away from underperforming or non-causal activities.

The traditional economic value curve reflects this struggle. As investment increases, outcomes like system uptime, productivity, or customer satisfaction rise—but only to a point. Eventually, the curve flattens. That’s the law of diminishing returns.

To thrive, not just survive, organizations must find a new way forward—one that focuses on precision allocation of effort, assets, and capital rather than brute-force spending.

Transforming the Economic Value Curve

Traditional economics teaches us that the more you invest, the more you gain—until the Law of Diminishing Returns inevitably kicks in. The early returns are often substantial as organizations invest in infrastructure, maintenance, or process improvements. But eventually, each new dollar yields a smaller benefit than before. The curve flattens, and efficiency stalls. Leaders are left wondering: Should we keep spending to squeeze out marginal gains, or is there a smarter path?

The Economic Value Curve illustrates this pattern. It is a visual model that depicts how an increase in a series of independent variables (such as costs, such as maintenance, operations, and staffing) yields a decreasing marginal improvement in the dependent variable (such as outcomes, such as uptime, throughput, and service quality), resulting in an economic plateau.

However, the curve doesn’t have to remain flat. Organizations can reshape it by utilizing causal understanding, reuse economics, and learning systems—driven by AI—to focus on the activities that provide nonlinear returns (see Figure 1).

Figure 1: Transforming the Economic Value Curve

The red line in Figure 1 represents a new trajectory: achieving more significant outcomes through smarter, more targeted investments. This captures the essence of doing more with less.

Exploiting the Modern Data Economic Force Multipliers

Leveraging modern data-driven economic concepts such as nanoeconomics, entity propensity models, the marginal propensity to reuse, and the data economic multiplier can transform the economic value curve. This enables organizations to improve outcomes with less input.

The Critical Role of Causal AI

As organizations look to do more with less, not all AI is created equal. We must understand which AI capabilities are best suited to identify the “more” and the “less.” Enter Causal AI.

Causal AI is a type of artificial intelligence that identifies cause-and-effect relationships, enabling organizations to understand what is happening, why it’s happening, and what will happen if they take specific actions.

As reflected in my many conversations with Mark Stouse of ProofAnalytics.io, causal AI clarifies why it happens. It enables organizations to diagnose what drives impact and simulate the economic effect of shifting resources, allowing them to transform the shape of their value curve confidently. It gives leaders insight into which actions influence outcomes and what will result from altering a variable. This understanding is essential for determining where to increase investments and where to scale back. For instance, causal AI could demonstrate that minor adjustments in patient triage result in significant enhancements in ER throughput, clearly highlighting where funding should be allocated.

While Causal AI is undoubtedly the highlight, it doesn’t operate in isolation. It works alongside other forms of AI to advance the “do more with less” economic equation.

Figure 2: Do More With Less: The AI Playbook

Here are the critical capabilities that the different types of AI bring to the “Do More With Less” equation:

🔼 The “Do More” Side of the Equation

“Doing more” doesn’t mean doing everything—it means doing what matters more and better. It’s about strategically amplifying the activities, decisions, and investments that create nonlinear value returns. These are the economic force multipliers—actions or interventions that, when properly understood and resourced, create cascading impact across operations, outcomes, and even innovation.

Causal AI plays a foundational role by helping us understand which interventions drive outcomes, enabling us to double down where it matters most. But it’s not alone. Predictive AI anticipates upcoming risks and opportunities, Generative AI powers new solutions, and reinforcement learning ensures each cycle improves upon the last.

For example, improving patient triage in an ER doesn’t just speed up admissions—it enhances throughput, reduces staff burnout, and improves patient satisfaction. That’s a do more multiplier.

By investing in these high-leverage activities and learning from every iteration, organizations can shift from linear growth to exponential impact.

🔽 The “With Less” Side of the Equation

“With less” doesn’t mean cutting indiscriminately—it means cutting strategically. It’s about eliminating duplication, reducing effort where the impact is minimal, and redirecting resources toward activities that produce the greatest return. It’s also about stopping the peanut-buttering of resources—spreading time, people, or funding evenly across all functions, regardless of their relative impact.

Causal AI shines here as well. It enables organizations to identify non-causal activities that may appear important on dashboards but don’t actually influence outcomes. By separating signal from noise, organizations can confidently reallocate.

Autonomous and Agentic AI systems further streamline execution by reducing the need for manual intervention. Reinforcement learning continuously prunes inefficiencies through feedback, while reuse economics (like the Marginal Propensity to Reuse) ensures that nothing valuable gets wasted.

Think of it as precision subtraction: removing what doesn’t move the needle so you can scale what does.

The bottom line is to reallocate resources—attention, personnel, money, time, and effort—and focus those investments on high-value initiatives and activities.

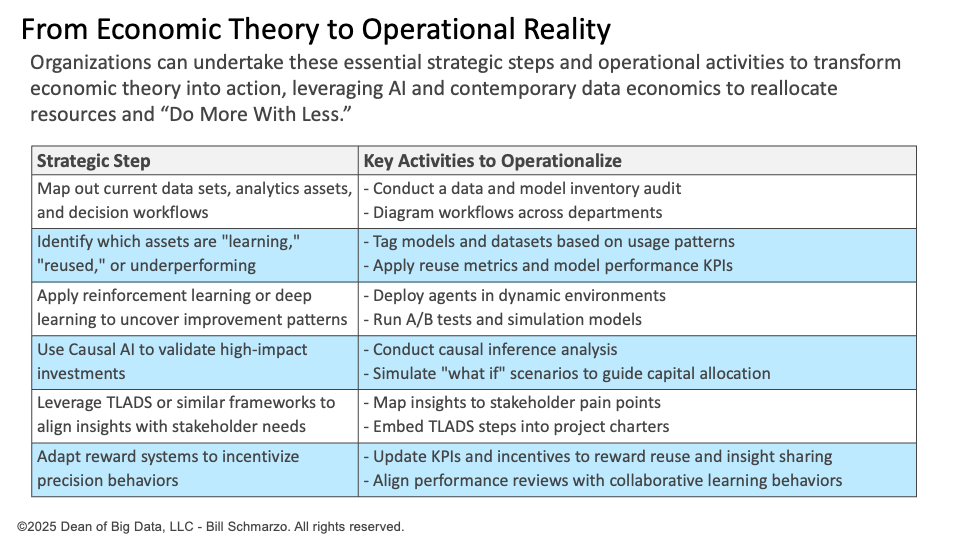

From Economic Theory to Operational Reality

Transforming your economic value curve requires a deliberate operating model that aligns your data, AI, people, and incentives around precision allocation. Here’s how to activate that vision:

Closing Thoughts

The future of enterprise success won’t be won by those who spend more—it will be led by those who allocate smarter. Causal AI, reinforcement learning, and modern data economics offer the clarity, agility, and leverage to compete in a world where every decision counts.

This is no longer about incremental efficiency. It’s about identifying and investing in the nonlinear multipliers—the leverage points that shift entire systems, while shedding the linear, low-impact efforts that no longer justify the cost.

This is the new value equation: Stop peanut buttering your precious resources and start investing in nonlinear multipliers. This will transform your economic value curve and allow you to do more with less.